How To Create and Modify Charges Under Companies Act, 2013

One of the factors for running a successful business is knowing the money requirements for your business and suitably arranging it. Whenever funds are required, a company has two options, one is, to arrange funds through the issuance of share capital (more capital is invested either by existing shareholders or by the new shareholder) and the second is arranging funds through an external source, i.e., funds through banks or public financial institutions.

In most cases, despite having no fixed cost, companies may not go for issuance of additional share capital as it may dilute the ownership of shareholders in the company. Therefore, to prevent their stakes, companies opt for loans/ finance from banks/financial institutions.

Loans or borrowing from banks or financial institutions are secured against the underlying assets of the company in the form of a mortgage or charge.

If you are about to apply for a loan or in the process of obtaining a loan for your business, this article will help you to learn about the process of creating a charge on a loan or any modification in existing charge and formalities when a charge is satisfied as given under Companies Act, 2013.

1. What is the charge and its types

- Term charge is defined under Section 2(16) of Companies Act, 2013, as “charge” means an interest or lien created on the property or assets of a company or any of its undertakings or both as security and includes a mortgage.

- Therefore, the charge is a security given to the lender against the property of the company. If a company fails to repay borrowed amount then the lender can recover such an amount through releasing assets against which the charge is created.

- Under the Companies Act, charges are divided into two categories namely Fixed Charge and Floating Charge.

1.1 Fixed Charge

- Fixed charges are those charges which are identifiable on specific assets of the company at the time of lending such as Land, building, Machinery, etc.

- Assets against which fixed charges are created can’t be sold by the Company unless the loan is completely paid off.

1.2 Floating Charge

- Under floating charges, no specific assets are identified at the time of lending such as Inventory, Debtors, etc.

- The Company is allowed to deal in such assets without the permission of the lender till the same is crystallized or becomes fixed.

1.3 Further Charge or Pari-Passu Charge

- These charges are not defined under the Companies Act and some are used in general business practices.

- Further Charge

- Depending upon the requirement of funds, a company may create further charges with the consent of the first charge holder on the same property for obtaining more loans from other banks/financial institutions.

- In this type of charge, the first charge holder gets priority for repayment in case the company winds up or goes into liquidation.

- On a similar analogy, there is one more type of charge known as the pari-passu charge wherein a single property has multiple charge holders but with equal rights of getting money in terms of their outstanding amounts.

2. How a charge is created or modified

- A charge is created on assets or property of a borrower by executing a loan agreement, creating mortgage deeds, or hypothecation agreements in favor of banks or financial institutions.

- Upon creation of a charge, the lender obtains the right in attached property or asset.

- It is also possible that once a charge is created, it can be subsequently modified by making amendments or addendums in the respective agreement or deed be it in terms of time frame or addition or reduction in the asset mortgaged.

3. How to register a charge

- The statutory provisions for registering a charge are given under sections 77 to 81 of the Companies Act, 2013 read with Companies (Registration of Charge) Rules, 2014.

- As per Section 77 of the Companies Act, 2013, every company creating a charge within India or Outside India shall register details of such charge with the Registrar of Company within 30 days.

- A company is required to following the below-mentioned procedure for registration of creation or modification of charges:

- Call board meeting and discuss matters of obtaining a loan or issuing debenture as per business requirements and decide the bank or financial institution and pass board resolution for obtaining loan and creation or modification of charge against that loan.

- Call an extraordinary general meeting and also pass a special resolution under section 180 of the Companies Act, 2013 authorizing the board of directors to borrow funds and create charges on assets to provide security for the loan in case the loan money exceeds the prescribed threshold in that section.

- File Form CHG-1 (other than debentures) or Form CHG-9 (debentures) within 30 days of creation or modification of charge.

- The details of the charge will include the date and description of the instrument, description of asset or property charged, date of board and special resolution, the amount secured by a charge on assets, and a list of terms and conditions of the loan.

- Attach the following document with Form CHG- 1 or CHG-9:

- The instrument evidence of any creation or modification of charge.

- Instrument(s) evidencing any creation or modification of charge in case of property acquired which is already subject to charge.

- If there is more than one charge holder, particulars of all joint charge holders.

- File Form MGT-14 for intimation of a special resolution to the Registrar.

- Pay fees prescribed in The Companies (Registration of offices and Fee) Rules, 2014

- Provide verification of every instrument evidencing any creation or modification of charge on the property situated in India or out of India with a certificate issued under the hand of any director or company secretary of the company or an authorized officer of the charge holder. For property out of India, such a verification certificate can also be issued under the hand of some person other than the company who is interested in the mortgage or charge.

- After vetting all documents, the Registrar shall register the charge and provide a certificate of registration of charge in Form CHG-2 (new charge) and Form CHG-3 (modification in charge).

4. What to do when a company fails to register Charge

- As per Section 78 of the Companies Act, 2013, if a company fails to register a charge within 30 days from the date of creation of charge then the person in whose favor charge is created, i.e., the lender may apply to the registrar for creation of Charge.

- The application shall be filed in form CHG-1 or CHG-9 along with instruments created for a charge.

- Upon receiving the application, the Registrar shall give notice to the company about the creation of the charge.

- Except in cases where the company itself registers a charge or shows sufficient cause why the charge should not be registered, the registrar shall register the charge within 14 days.

- The charge shall be registered on payment of the applicable fee.

- The lender shall be entitled to recover such an amount of fee or late fee from the company.

5. How to record charges in the register of charges by company or Registrar

5.1 Register by company

- Every company is required to maintain a register of charges in Form CHG-7 containing details of all types of charges registered with the Registrar on assets and any property or asset acquired which is subject to any charge.

- Any modification in the existing charge or satisfaction of the charge will also be recorded in the same register.

- These registers are required to be preserved for 8 years.

- Further, any member or creditor is allowed to inspect the register of charges without fees and any other person can also inspect by paying respective fees.

5.2 Register by Registrar

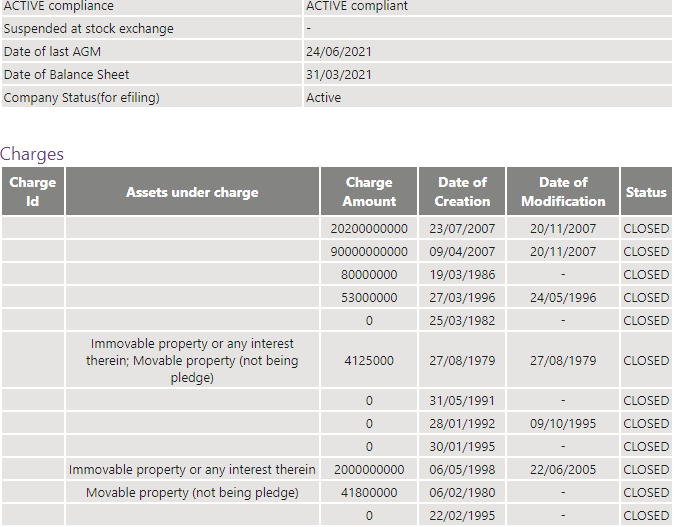

- In the light of the alarming situation of non-payment of debts, the Ministry of Corporate Affairs requires the Registrar to maintain a register of charges for every company and the same shall also be available on the MCA portal.

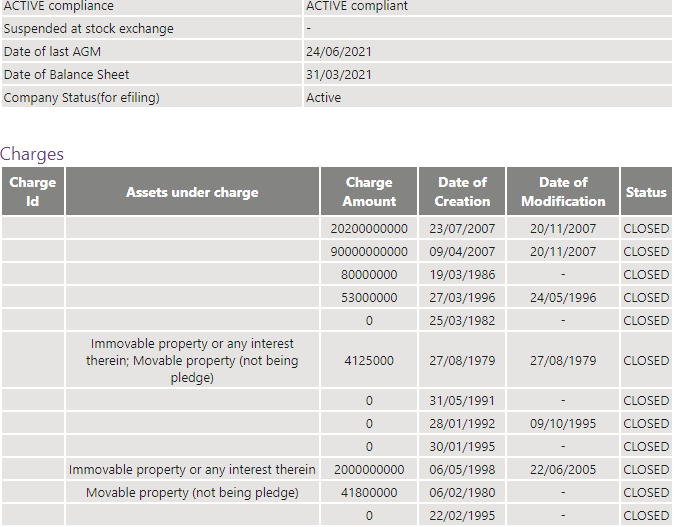

- Information about charges registered against the company can be checked on the MCA portal without payment of any fee under the “Company/LLP Master Data” tab. Information appears on the MCA portal in the following manner:

- However, a detailed form can be checked after making payment of MCA Fee.

5. What to do when a charge is satisfied

- Satisfaction of a charge means repayment of entire loan money and clearance of title on assets kept as security through charge for the loan.

- Once the charge is satisfied, the intimation is to be given to the Registrar about the same in Form CHG-4 along with requisite fees within a period of 30 days from the date of satisfaction of charge.

- Thereafter, the Registrar will provide a certificate of registration of satisfaction of charge and duly update the register by recording a memorandum of satisfaction of charge.

- Upon satisfaction of charge, status of charge updates as “CLOSED” on MCA portal.

6. What happens if a charge is not registered by either Company or the lender

Not registering a charge created on an asset or property of a company will lead to the following two consequences:

- Charge shall not be considered at the time of liquidation or winding up under the Companies Act, 2013.

- Levy of penalty on companies of INR 5 lakh or on officers in default of INR 50,000.

7. Charges exempted from the requirement of registration

In the following cases, charges are not required to be registered:

- Guarantee;

- Charge created by operation of law;

- Negotiable Instrument (Hundi) is not a ‘Charge’ and therefore, registration is not required.